Cargo Insurance for Cannabis Businesses

What is Cargo Insurance?

Moving goods from one location to the next can be risky. Cargo insurance provides the coverage you need in the event of an incident, allowing you to recoup your losses and replace your lost or damaged goods.

Cargo Insurance is an insurance policy that protects goods in transit. Coverage is available for protecting your business’s goods in transit, such as cannabis flower, vape pens, cash/money and securities, and other items of value while on the road. Cargo can also cover goods in your care, custody, and control, such as a distribution company for hire and transporting cannabis products for another company.

When should you consider buying cargo insurance?

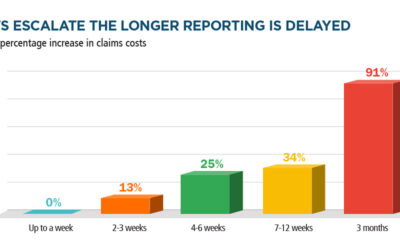

Whenever you have high valued goods in transit, it’s always a good idea to consider insuring the product or goods. If product is lost, stolen, or damaged, cargo insurance will pay the actual cash value of the loss and will also cover income loss replacement if the cargo is irreplaceable. For example, a harvested crop would be considered irreplaceable since it may have taken the cultivator up to 4 months to harvest before it was distributed and “in transit.”

The type of cargo policy needed for your business will depend on your specific cannabis operation. Factors include what you are transporting, the actual cash value of the goods being transported, and the distance of travel. These are all crucial factors when considering the right policy for your business. If you are an armored transportation company, there is also coverage for cash in transit up to $1,000,000.

What’s Typically Included in Cargo Insurance?

Cargo insurance typically covers the following for cannabis businesses:

- Overturn/Upset

- Refrigerated Equipment Breakdown

- Theft

- Fire

- Smoke damage

What are the benefits of having cargo insurance?

Reduce Exposure to Financial Loss

Whether you’re waiting for a shipment of product to sell from your place of business, or delivering goods directly to your customers, you run the risk of incurring significant losses if your goods are damaged or stolen during transit. Cargo insurance will provide a financial backstop in the event of a catastrophe.

Have More Control Over Insuring Terms

There are instances where it’s a viable option to rely on a buyer’s or seller’s insurance policy to cover goods in transit. Still, you must ensure that the terms of the policy are enough to satisfy your specific needs. Investing in your own insurance policy allows you to customize the package as you see fit, giving you more control to meet the needs of your business.

Tips for Choosing Cargo Insurance

Look for a Variety of Flexible Policies

Your insurance policy is based on the specific needs of your cannabis operation. When choosing a cargo insurance policy, keep on the lookout for flexible coverage options that gives you the ability to tailor the policy to your needs.

Find a Qualified Insurance Broker

There’s plenty of insurance brokers who will sell you an insurance policy and leave you hanging to figure out the rest for yourself. A good insurance broker will walk you through the various rules and regulations required to navigate a legal claim. In addition, you’ll want an insurance broker that understands the nuances of the cannabis industry, allowing you to steer clear of breaking any laws or regulations.

Get a Cargo Insurance Quote

For a quote or to learn more about cargo insurance, reach out to us today.