COMMERCIAL AUTO insurance rates have been on the rise since 2011, increasing often by more than 10% a year as accidents and claims costs have soared.

The trucking industry has been the hardest hit by the steep increases, and there are a number of factors contributing to the rate hikes, according to a recent study by Risk Placement Services.

One of the biggest factors is that insurers have had trouble keeping up with increasing accidents and spiraling claims costs, leaving them in the red for most of the past decade. But there are other lessknown factors, including the following:

Good drivers are aging and retiring

Half of all long-haul truck drivers are over 46 years old; they are aging and retiring, leaving a dearth of experienced drivers.

As the industry rushes to hire more drivers, it has to contend with having more inexperienced drivers who are more likely to be involved in accidents.

Large jury verdicts growing – The number of transportation sector damage awards exceeding $10 million for injuries and property damage has been increasing since 2012.

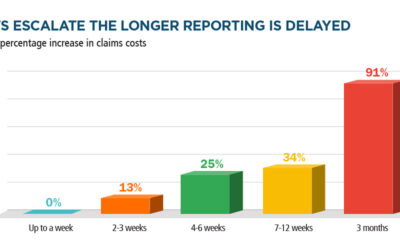

Claims for bodily injuries can take years to resolve, causing insurers to initially underestimate the eventual loss amounts.

High maintenance costs – While advanced technology has made trucks safer, that tech is expensive to maintain, repair or replace. On the flip side, skimping on maintenance can lead to more accidents.

Distracted driving – Truck drivers and those they’re sharing the road with continue looking at their phones, eating, looking at their navigation systems, and taking their eyes off the road with increasing regularity. This increases the frequency of accidents.

Dangers of crumbling infrastructure –

America’s deteriorating roads and bridges are increasing wear and tear on trucks, making accidents more likely.

Expensive cargo – The goods inside the trucks are also requiring larger amounts of insurance at higher rates. For example, shipments of electronics and medicine are magnets for thieves. And if a flatbed trailer carrying expensive machinery flips over, the cargo will likely be damaged beyond repair and the insurer has to pay to replace it.

Products like food, flowers and some medicines must be refrigerated; if the driver makes a mistake or something goes wrong with the refrigeration in the trailer, the entire lot may be ruined.

The takeaway

The Risk Placement Services report concludes that businesses with larger vehicle fleets, someone responsible for safety and that hire quality drivers and practice regular maintenance, will find insurance more affordable and available.

For the rest, the rate increases will likely continue.

Get a Quote

If you’re looking for a team of specialists who can help your cannabis business navigate state laws and regulations like this, contact Cannabis Connect today for a free quote.