What do you expect from your insurance broker? Industry involvement, expertise, and experience are often what first comes to mind.

A cannabis insurance broker is an insurance agent that specializes in insurance policies for the cannabis industry. With laws and regulations constantly changing, the need for a nuanced broker to help you navigate the industry and stay on the legal side of the law is imperative.

Having a policy to deal with fire, theft, or property risk along with the ability to insure yourself against possible customer claims is a necessity for businesses in the cannabis industry. A cannabis insurance broker can pinpoint the specific needs of your business and help you find the policies you need to ensure you’re fully covered.

Navigating Cannabis Business Insurance

The biggest hurdle facing many cannabis-based businesses today are largely legal in nature. In some states cannabis is legal, in others it’s banned, and in others still, it sits in a grey area.

For these reasons, major insurance companies refuse to offer policies to businesses within the cannabis industry. Often, cannabis business owners are forced to settle for less than stellar insurance policies that leave massive gaps in their coverage.

This creates a minefield of legal pitfalls that must be navigated with the utmost of care. Between the time investment, tiptoeing around federal law, and dealing with the rigors of day-to-day business operations, running a business in the cannabis industry is no easy task.

This is why it’s vitally important you have a broker in your corner who knows the ins and outs of the industry. Your broker should be involved in the cannabis industry and should have the experience needed to craft a surefire plan specifically tailored to your business.

Most insurance companies aren’t willing to take a chance on an industry that comes with so much risk and legal grey area. That’s why it’s vital cannabis businesses find an insurance policy designed specifically for the cannabis industry.

What should you look for in an Insurance Policy

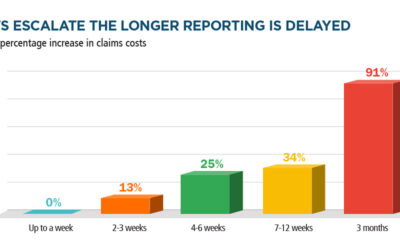

One of the primary ways a cannabis insurance broker will benefit your business is by identifying the key factors of a great insurance policy. A broker will save you time, money, and keep you focused on what’s important.

A cannabis insurance broker should help you identify these key factors as they help you find the right insurance policy:

Limits

If a claim were to arise, how much coverage do you need? How much do you want? Given the size of your company, what are the risks, and how much do they cost?

Premiums

How much does your insurance policy cost you on a monthly and annual basis? Take your long-term plans into account as you search for the right insurance policy.

Terms & Conditions

Every policy comes with a unique set of terms and conditions. Consider the needs of your business and see what should be included or excluded to ensure all of your risk points are covered. The right broker will identify your exposures and negotiate terms favorable to your business.

Finding the Right Cannabis Insurance Broker for Your Business

Find the coverage that best suits the needs of your business, and avoid legal pitfalls by working with a qualified cannabis insurance broker. The right broker will walk with you hand in hand to ensure you have the coverage you need.

Get in Touch with a Cannabis Insurance Broker

At Cannabis Connect Insurance we understand the difficulties cannabis business owners face on a day to day basis. Our team of professional insurance brokers will help you find the right insurance policy for your business. Contact us today for a quote.