PERSONAL AUTO insurance rates continue increasing and even motorists who have had no accidents or moving violations are seeing their premiums climb at some of the highest rates for decades. Continuing a trend from the past six years, premiums increased an average of 17% in the first half of 2023, according to Insurify, Inc. The online insurer’s report predicts that rates will climb another 4% by the end of the year. The rate increases noted in the report are a national average, and premium hikes vary from state to state, with some states seeing rises in excess of 30%. According to the report, the national average cost of car insurance is $1,668 per year.

Factors behind rate hikes

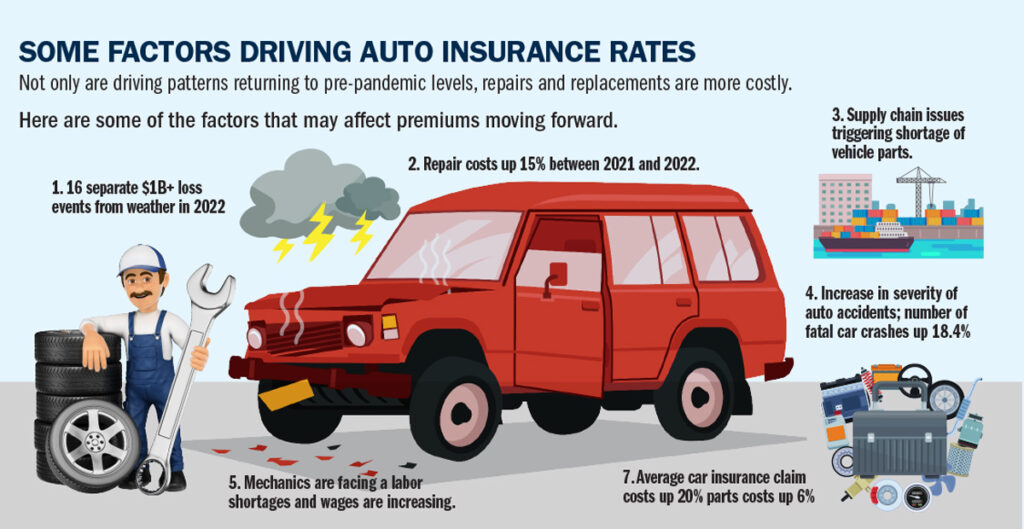

Higher repair costs – The average price of auto parts and equipment has risen 70% in the past 20 years due to inflation and supply chain disruptions from the pandemic and the Ukraine-Russia war, according to the Bureau of Labor Statistics. A shortage of skilled mechanics has also driven up repair costs. As well, newer cars cost more to repair due to their increasingly sophisticated and expensive technology.

Natural disasters – Natural catastrophes like hurricanes, wildfires, and floods are increasing both in number and scope.

More serious accidents – While car accidents are decreasing in number, per-accident costs (property and personal injury) are rising at an annualized rate of 4%, according to a report by the Insurance Research Council. Also, from 2018 to 2022, the number of fatal accidents in the United States increased by more than 16% to 42,795.

What you can do

There are a few steps you can take that may affect your premium:

Tap insurer discounts – Many insurers will offer premium discounts for:

- Paying premiums via automatic payments.

- Maintaining good grades.

- Safe driving habits.

- Anti-theft and safety features.

Bundling – Insurers will often offer discounts to customers who bundle policies, like auto and homeowner’s or renter’s, as well as umbrella.

Raise your deductible – If you raise your deductible, the premium you pay will decrease. But be careful, the higher you raise it, the more “skin in the game” you have if you have an accident. Remember, the deductible is what you will pay after an accident or theft before your insurance company steps in to cover the rest.